The final details of the Pakistan Budget 2025-26, including salary increases for government employees (BPS 01-22), are still under review. However, the Budget Call Circular (BCC) for FY 2025-26 has been issued by the Punjab Finance Department, outlining the process for budget preparations. Here’s what employees can expect:

Steps in the Budget Process

Budget Call Circular (BCC) Issued

Guides provinces/departments to submit proposals.

Includes Revised Estimates (2024-25), Budget Estimates (2025-26), and ADP (Annual Development Program).

Departmental Proposals

Salary increase recommendations for federal/provincial employees.

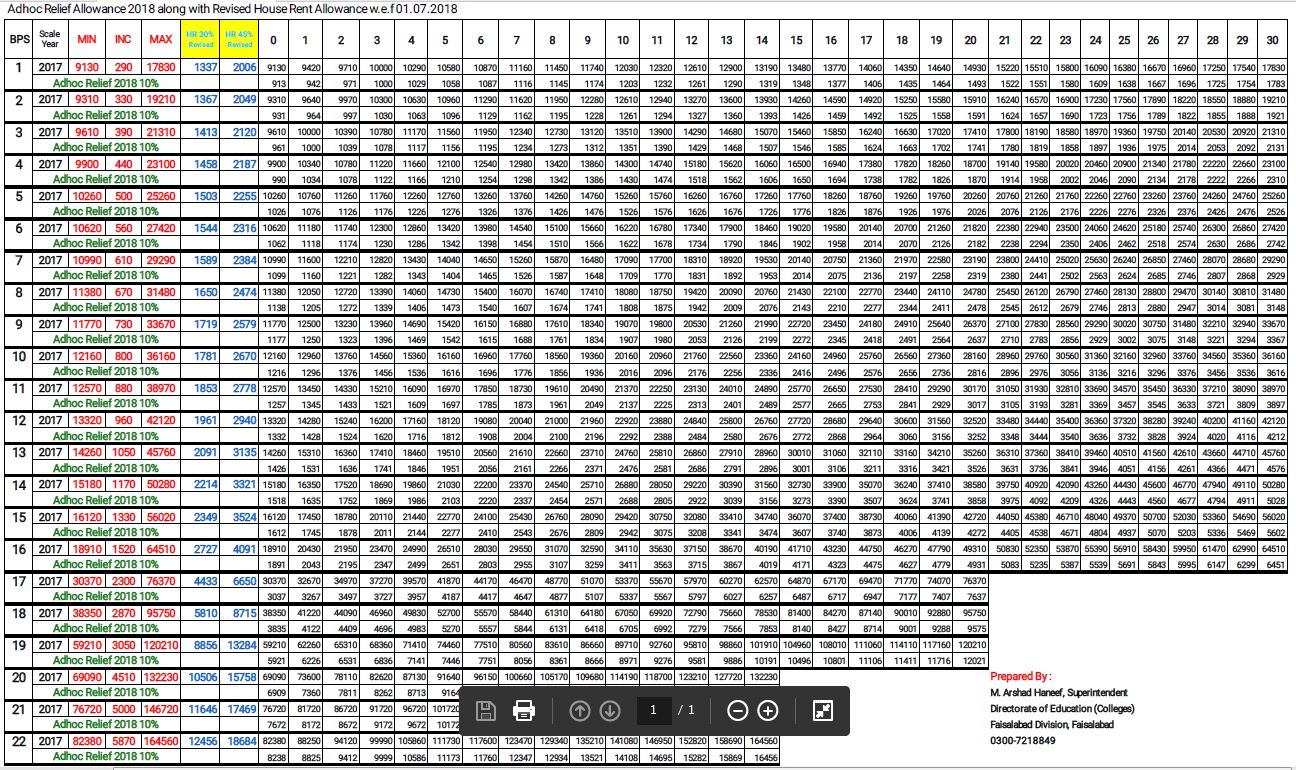

Adjustments to allowances (DA, housing, medical).

Final Approval

Federal/provincial governments will finalize increases after review.

Expected Salary & Allowance Changes

Projected Increase: 15-20% (varies by pay scale, pending approval).

Minimum Wage: Likely raised to PKR 37,000/month.

Allowances: Potential hikes in Dearness Allowance (DA) and housing benefits.

Where to Check Official Updates?

Ministry of Finance: www.finance.gov.pk

Punjab Finance Department: finance.punjab.gov.pk

Khyber Pakhtunkhwa Finance Dept: kp.gov.pk/finance

News Sources: GEO, ARY, Dawn, Express Tribune.

Timeline for Announcements

June 2025: Federal/provincial budgets presented.

July 2025: Final salary charts (BPS 01-22) released.

Download Here Budget 2025-26 Pakistan Details

Zeshan Akram, a professional blogger since 2013, specializes in educational content. With a Master’s degree from AIOU, he is a trusted source for Pakistani education insights on biseworld.com.